When you think of a credit card, you would probably imagine a salesperson chasing you in the mall. He or she would explain the perks, cashback value, free gifts and more to get your attention. We would all prefer to walk away most of the time. But, have you ever thought about why there are people who register for credit cards? Today we are going to discuss The Lazada Citi Bank Credit Card in Malaysia. Read on to find out more!

Do you know the types of payment cards available?

With the current trend in cashless payment, everyone is holding at least one card. Let’s learn about some types of payment cards available.

- Credit Cards – One of the two common payment cards. Usually comes with a credit limit. Repayment is at least the minimum amount. The holder must make the payment at the end of every month.

- Debit Cards – The other common payment card. Originates from the bank that the holder has an account with. No repayment required. The limit depends on the funds in the account linked to the card.

- Charge Cards – It is similar to credit card. The repayment must be the full amount during month-end. If any charge roll over to the next month, a surplus charge applies. Sometimes, it comes with a yearly fee.

- Business Travel Cards – Functions the same as the other cards. Designed specifically for frequent travellers. Ensures easy payment for business travelling expenses. Usually comes with extra perks like insurance and facilities for the travellers.

What are the main credit card types?

This question actually refers to the credit card network. Every credit card has a specific network company. This is what processes the payment and transaction. Here are the four main credit card networks:

- Mastercard

- American Express

- Visa

- Discover

What are the pros of having a credit card?

We are told that usually only rich people use a credit card because they have lots of money. That is completely untrue. Anyone can use a credit card as long as they have discipline. A self-control to avoid overspending.

Let’s find out some of the pros of being a credit card holder.

- Credit Score – An important aspect especially if you’re looking to apply for a loan. This is the score that the banks pay attention to. It helps to determine if you’re a good paymaster. The bank will be confident that you can be trusted to lend money and repay later.

- Cash Back – The main attractive point of every credit cards out there. Imagine getting back a small amount of your cash spent. Most credit card companies offer 1% cashback. However, there cashback at 2% and 3%. Some even offer up to 6% cashback but on selected transactions.

- Reward Points – Redemption of reward points is truly rewarding! This works by converting a certain cash amount to points. For example, for every RM5 spent, you get 2 reward points. Once you have accumulated a certain number of points, feel free to redeem for gift cards, restaurants, etc.

- Flyer Miles – This perk works great for frequent travellers. Some credit card companies work closely with airline companies for this. Every time you swipe to buy your flight ticket, it adds on to your flyer miles. As a regular traveller, you can afford to travel for free on one of your trips!

- Safety – If your card is being used for fraud or stolen, every usage will be reflected in your statement. It is not deducting directly from your account, like a debit card. So, you can lodge a complaint and an investigation will be done. You can then choose to pay the whole bill or only the accurate ones while waiting for the money to be restored to your account.

What is the Lazada Citi Credit Card?

A credit card designed as a result of a partnership between Lazada and Citibank. This is to provide frequent shoppers of Lazada with amazing perks from both companies. Cardholders can enjoy various rewards, offers and discounts. It also comes with great cashback value and notable reward points.

What are the perks of the Lazada Citi Bank Credit Card in Malaysia?

Since it’s a collaboration between two high-end organisations, you can expect to enjoy only the best rewards. Even more if you’re a loyal customer of Lazada. With its amazing Reward Point system, you can swipe everywhere and get the most out of it!

10X of Reward Points

Enjoy a lumpsum of reward points when you shop on Lazada using Lazada Citi Bank Credit Card or Lazada Wallet. All you have to remember is to top up your Wallet using Lazada Citi Credit Card. Then, just shop away and let the points flow in!

5X of Reward Points (*selected categories)

When you use Lazada Citi Credit Card to pay for certain categories, you can redeem up to 5x of reward points! This applies to online subscriptions, food delivery services, your insurance and telco services. We’re all avid users of Netflix, YouTube, GrabFood and more so this is the perfect credit card to have on hand.

1X of Reward Points

Don’t be upset that the point system covers certain categories only. Any other expenditure other than the ones stated above will earn a 1x point. This includes paying for petrol and other retail purchases.

Monthly Bonus Rewards Points

With the current need for everything virtual, from ordering food to buying washing machines, online purchases happen every month. What if you earn monthly bonuses as you spend for the normal transactions? With Lazada Citi Credit Card, when you spend at least RM1500 in a month, you can get extra 1000 Rewards Points! This way you are spending the same every month but get something in return.

Now that you have diligently collected all your points, you can happily use them to offset the purchases in your Lazada wish-list! It is very much like winning a free gift by spending just the same amount with the Lazada Citi Bank Credit Card.

Here are some of Lazada’s perks for you!

Lazada is one of Malaysia’s largest online store and most definitely has the best benefits for their customers!

- Using the Lazada app, you can redeem vouchers for free shipping, exclusively for cardholders.

- Earn up to 20% of cashback value for your Lazada Wallet when top up with your card.

- All year long of sales, offers and vouchers for many Lazada products.

- Special Lazada x Citi Mondays, where you get RM28 off your Lazada transactions every Monday

What are the requirements to apply for the Lazada Citi Credit Card?

After reading about all those perks, pretty sure you would like to sign-up for this card. Before you do, do have a look at the requirements and required documents below:

| Malaysian | Non-Malaysians |

|---|---|

| RM24 000/year minimum earnings | RM120 000/year minimum earnings |

| Copy of MyKad (both sides) | Copy of Passport |

Documents for employed:

|

Documents for employed expatriates:

|

Documents for self-employed:

|

For the principal cardholder, the minimum age requirement is 21 years old while for the supplementary cardholder, it is 18 years old.

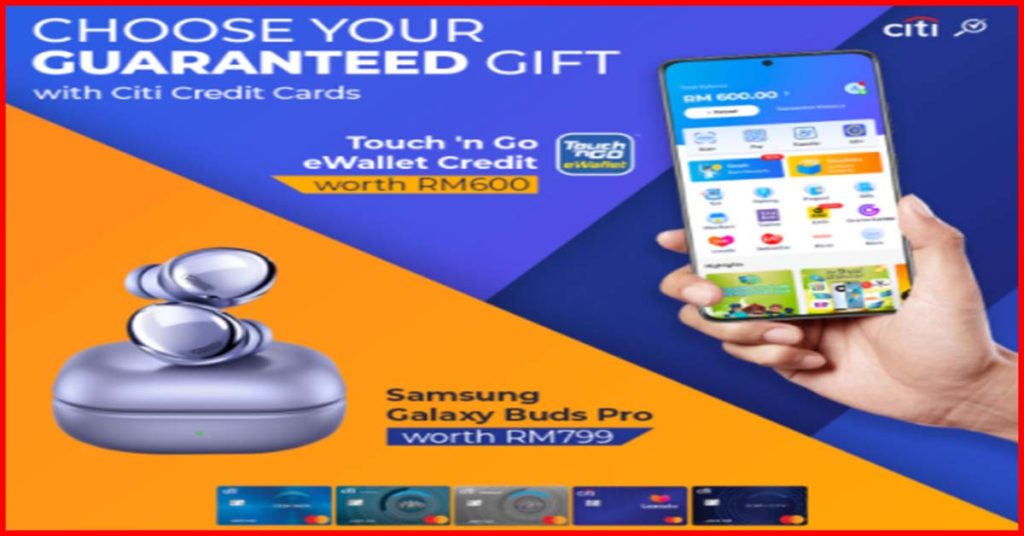

Got any free gift ah?

As Malaysian, we really love a good free gift when we sign up or buy something. With this credit card (or any Citi cards), you can CHOOSE your guaranteed gift! How amazing is that?

When you sign-up, you have the option to pick between:

- Touch ‘n Go eWallet Credit (worth RM600); or

- Samsung Galaxy Buds Pro (worth RM799).

*Applicable for new Citi Credit Card applicants only

In a nutshell, the Lazada Citi Bank Credit Card in Malaysia is the best option if you’re a first-timer, a frequent Lazada shopper and loves multiple perks in one!

For more information on terms and conditions, kindly refer to the links below:

Lazada Citi Credit Card, here.

Features of credit card, here.

Terms and conditions for Lazada Citi Platinum Card, here.

Terms and conditions for Lazada Citi Platinum Card Offer, here.

Terms and conditions for Citi Credit Cards, here.

Fees and charges for Citi Credit Cards, here.