Are you considering buying insurance, but don’t know which insurance company is the best in Malaysia? Wait up, because we have reviewed and picked the 10 best insurance company in Malaysia, especially for you!

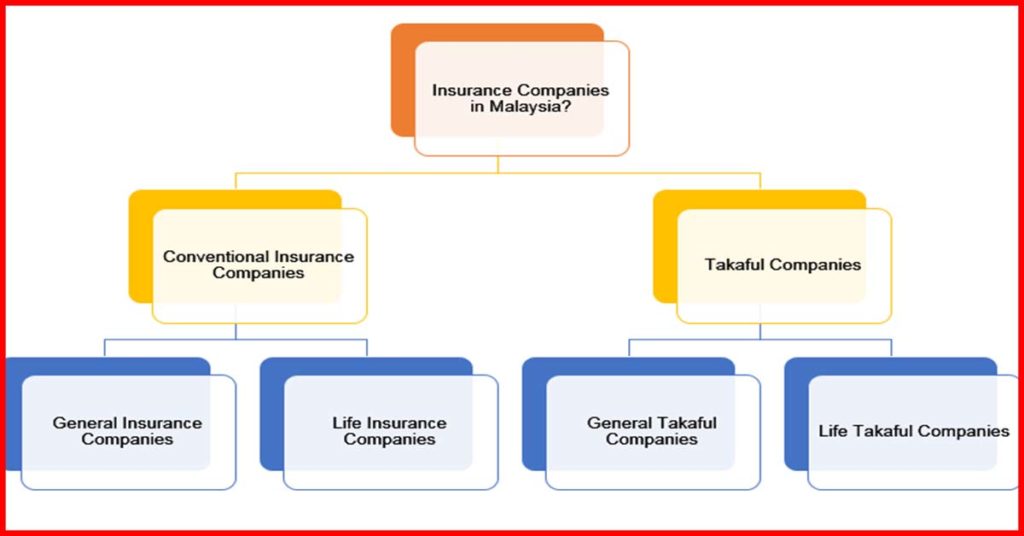

Before we go deeper into the Insurance Companies in Malaysia, let us explain the types of Insurance Companies that are available in Malaysia.

Types of Insurance Companies

First, we have the conventional Insurance Companies, which offer conventional insurance products for consumers.

Second, the opposite to the conventional Insurance Companies, are the Takaful Companies. Takaful is basically Islamic insurance, but since it is Islamic financing and banking, the term insurance is not applicable, but it is called Takaful instead.

Takaful is another option for insurance protection, apart from conventional insurance. There is basically a difference in the concept and product mechanism, but above all, both conventional insurance and Takaful is providing protection coverage for the customer.

So, on top of the options of conventional Insurance Companies, and Takaful companies, there is also segregation in terms of the products, whereby there are General Insurance Companies / General Takaful Companies, and Life Insurance Companies / Life Takaful Companies.

Wait, don’t get confused yet. It is really very simple. Check out the following illustration we have prepared for you.

General Insurance / Takaful products are basically non-life products, meaning that the insurance protection coverage is for buildings, houses, vehicles, and travel protection. For example, when you are looking to buy insurance for your car, you need to go to a General Insurance / General Takaful company.

Whereas Life Insurance / Takaful is covering you in terms of your life protection, medical, and health. For example, if you are looking for medical coverage protection to compensate in events where you are admitted to the hospital, you need to look into products offered by Life Insurance / Takaful company.

What are the 10 best insurance companies in Malaysia?

So now that you understand the difference between the Insurance and Takaful companies in Malaysia, as well as the segregation between General Insurance and Life Insurance, let us find out the top 10 best company in Malaysia you can go to for Insurance / Takaful protection.

Allianz Malaysia is a conventional insurance company, that has both General Insurance and Life Insurance products. The General Insurance product is through Allianz General Insurance Malaysia Berhad, while the Life Insurance product is through Allianz Life Insurance Malaysia Berhad.

Allianz Malaysia is part of Allianz Group in Germany, and the name is known for being one of the best insurance providers throughout the globe. Allianz has over 100 million customers in 70 countries across the world, and still growing its market in the insurance industry.

This is another big name in insurance that you must have heard before, right? Zurich is another well-known company that is providing General and Life Insurance protection in Malaysia.

The company is part of the Zurich Insurance Group that operates globally and is well known for being one of the best insurance companies in the world. You definitely can rely on the products offered by Zurich Insurance for the well-being and peace of mind of you and your family.

Prudential Assurance is a life insurance company, that is originated in London. They are one of the leading life and medical insurance companies in Malaysia, that provides an array of products for savings, protection, and investment needs.

This is another well-known and international life insurance company that operates in Malaysia. AIA has a very good reputation in terms of international standard life and medical insurance products, as well as being able to offer Life and Medical Takaful.

AIA offers a wide array of life and medical insurance products, and they are also specialized in tailored products for niche consumers.

Give a look at the options AIA offers for the benefit and protection of you and your family at their website!

The Tokio Marine brand is also known in the eyes of the world for being the pioneer in the insurance industry. Established in Tokyo, Japan in the year 1879, the company is now operating globally and offers both General Insurance products and Life Insurance products.

Through two entities namely, Tokio Marine Life Insurance Malaysia Bhd. and Tokio Marine Insurance, the company provides options of all types of insurance protection and coverage.

There are four main entities/companies that operate under the brand name Etiqa. The name Etiqa is providing a comprehensive solution to your insurance needs because they are able to offer everything, from conventional insurance to Takaful protection, as well as General and Life insurance.

Under the brand name Etiqa, there are the following organizations:

- Etiqa General Insurance Berhad (EGIB)

- Etiqa Life Insurance Berhad (ELIB)

- Etiqa General Takaful Berhad (EGTB)

- Etiqa Family Takaful Berhad (EFTB)

But don’t worry about getting confused and mixed up, because all the products that Etiqa offers are centralized under the same website. Hit their website and find out the amazing products that they offer and learn how you can protect yourself and your family with Etiqa.

Great Eastern is a reliable insurance company that you can go to for the best insurance protection. They offer both General Insurance and Life Insurance products and operate in Malaysia through two main entities of Great Eastern Life Assurance (Malaysia) Berhad and Great Eastern General Insurance (Malaysia) Berhad.

You can reach them through their website to learn more about the insurance solutions provided by Great Eastern.

This is another conventional insurance company in Malaysia that offers both General and Life Insurance products. The brand AXA is associated with AFFIN Bank Berhad, and they are operating in Malaysia ever since 1975.

Currently, AXA is serving over 1.5 million customers nationwide through its array of General and Life Insurance products. AXA is a reliable choice for your insurance needs and solutions.

This Takaful company is known in Malaysia under the name Takaful Malaysia. They are the pioneer Takaful operator in Malaysia and have been serving in the Takaful and Insurance industry since 1981.

Through their Takaful business, Takaful Malaysia is offering both the General and Life Takaful products for customers in Malaysia.

Although the products offered by them are using Islamic financing and banking principles and concepts, it is not only limited to Muslim customers only. Non-Muslim customers can also opt for Takaful protection.

Takaful Ikhlas is another option for Takaful coverage and protection in Malaysia. The brand name Takaful Ikhlas is established in 2002 and has been one of the largest Takaful operators in Malaysia.

Under Takaful Ikhlas, you can get Takaful protection and coverage for General and Life Takaful. You can get comprehensive coverage and protection from Takaful Ikhlas and enjoy the benefits of being their customer.

Head down to their website to find out more about the different Takaful products offered by Takaful Ikhlas and learn how the company can provide you with the best solution to your insurance needs.

Frequently Asked Questions (FAQs)

What is Takaful and what makes it different from Conventional Insurance?

Takaful protection is another option for insurance protection, but it is according to the Shariah principles. According to Islam, Insurance transaction is considered Haram, thus, it is recommended for Muslims to opt for Takaful instead.

Takaful is the Halal alternative of insurance, whereby the concept and mechanism are according to the Shariah principles. Takaful is not an activity of selling and buying protection or coverage but uses the concept of mutual risk sharing, whereby people that buy the Takaful protection enter a contract of mutual risk-sharing among them.

On top of that, all investments managed by the Takaful company are made according to the Shariah law and concept, whereby it is invested in Halal and certified Shariah Compliance funds.

Where can I buy Insurance protection for me and my family?

Since the digital and internet world is so popular, all insurance companies in Malaysia are also available on the internet. Hence, you can just type in the name of the insurance company that you prefer and can straight head to their website to discover the options they provide for your insurance needs.

I am a non-Muslim, but I find that the prices for Takaful products more interesting as compared to Conventional Insurance products. Can I buy Takaful protection for me and my family?

Yes, although the Takaful products are according to the Shariah principles, the customers, or called participants are not necessarily Muslims. Non-Muslim can enter the Takaful contract, and enjoy the attractive packages offered by Takaful companies.

Conclusion

Now that you know the types of insurance companies available in Malaysia, as well as the details of each company, you can decide which best insurance company in Malaysia suits you the best. All insurance and Takaful companies in Malaysia are heavily regulated by Bank Negara Malaysia (BNM), so you don’t have to worry about being cheated or any misconduct.

Insurance and Takaful protection are important to you and your family. We never know when the rainy days are going to come, so it is better to prepare yourself and the entire family with adequate protection through insurance and Takaful.